About Department

Department of Finance is internally divided into branches, each of which is responsible for different function. For instance :

- Expenditure Branches, which are six in number are responsible for managing budget allocation and subsequent expenditure of various Administrative departments allotted to each one of them.

- Finance Personnel branches, which are two in number deal with policy/rules and their interpretation involving personnel matters having financial implications.

- Budget branches, again two in number have the primary responsibility of budget preparation, deal with subsequent associated matters and coordinate with Accountant General of Punjab.

- Finance Pension Policy and Coordinating branch deal with matters related to pensions and is also responsible for general coordination.

Further Department of Finance also consists Of Directorates which are as under :

- Directorate of Institutional Finance and Banking

- Directorate of Treasuries and Accounts (T&A)

- Directorate of Pensions and Welfare of Pensioners

- Directorate of Small Savings

- Directorate of Public Enterprises and Disinvestment

- Directorate of Financial Resources and Economic Intelligence (DFREI)

- Public Infrastructure Development Board (PIDB)

- Punjab State Lotteries

- Punjab Infrastructure Regulatory Authority

Directorate of Institutional Finance and Banking

- This Directorate was set up in Punjab in April, 1981. The major activity of the Directorate of Institutional Finance and Banking is to explore every possibility to propose bankable projects in the State so that more and more Institutional Finance is availed and burden on State exchequer is brought to the minimum.

- The Directorate maintains liaisoning with Commercial Banks, Financial Institutions, various Departments, Boards and Corporations which are implementing the Schemes/Projects through Institutional Finance. The liaison is well maintained through an effective machinery of co-ordination at Block, District and State level.

- State Level Bankers' Committee(SLBC) is the State Level Bankers forum comprising of heads of Banks and State Government departments. The meetings of the committee are held quarterly to review the progress of Banks during previous quarters. So far, 149 meetings of SLBC have already been convened. It is ensured at Directorate end that the full participation is made in these State level meetings and the issues faced by Banks and State Government Departments in the implementation be discussed at length so that various Central and State schemes are implemented in an effective manner.

- In order to promote rural lending, Punjab Gramin Bank(in which State is having a stake of 15%) is functioning in the State of Punjab. The Directorate of Institutional Finance and Banking has nominated Deputy Director(IF) as a State representative on the Board of Directors of this Bank for effective monitoring.

- This Directorate also helps the Banks by taking up their cases with district authorities for recovery of their long pending dues. All types of administrative support are provided to the Banks through District Administration so as to encourage them for lending under Centrally Sponsored Schemes.

- All types of complaints received by State Government or other agencies against Banks are dealt with. Matters are enquired into through controlling heads/officers of Banks and then settled, to the satisfaction of the complainants.

- The Directorate supports in implementing policies and guidelines issued by Reserve Bank of India from time to time for development of banking sector in the State and also ensure adherence thereof by the Banks.

- The Direct Benefit Transfer(DBT) Cell has been set up at Directorate of Institutional Finance & Banking. A State portal has been created for on-boarding of Central and State Government Schemes. Upto 31.05.2019, 120 Central and State schemes of 14 departments have been on-boarded at State DBT portal. The State DBT Portal has been integrated with DBT Bharat Portal. The progress of the DBT Schemes is being reviewed by the Directorate on regular basis.

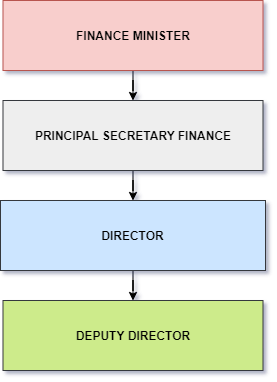

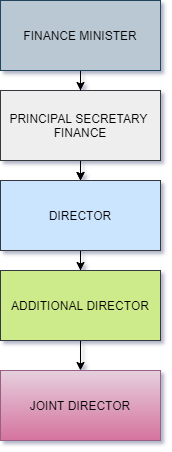

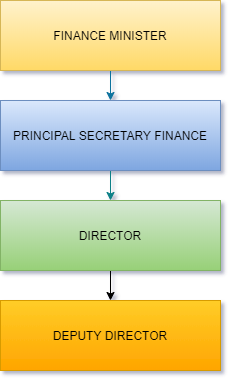

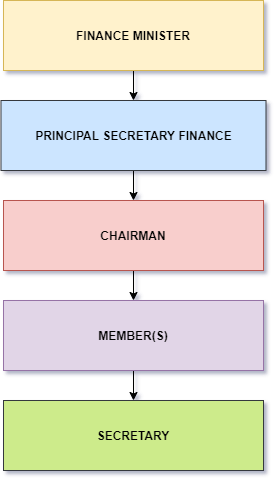

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Smt. Garima Singh, IRS | Special Secretary Finance-cum-Director | 0172-2747768 | splsecyfinancepb@gmail.com |

| 2. | Sh. Sanjeev Kumar Aggarwal | Deputy Director | 0172-2660028, 2660034 | dfinancebanking@gmail.com |

Directorate of Treasuries and Accounts (T&A)

The Directorate is entrusted with the task of overall financial management and control in the State through Treasuries, Accounts Personnel's and Internal Audit of various Administrative Departments. The Directorate consists of three wings namely :

- Treasuries & Accounts

- Internal Audit Organization (Revenue)

- Principal Accounts Office (New Pension Scheme), Mohali

Treasuries & Accounts

Director, Treasuries and Accounts (T&A) is the controlling and monitoring authority of the Treasuries in Punjab. The Directorate controls and supervises 21 District Treasuries (including Punjab Treasury Chandigarh) and 75 Sub treasuries (including one Pay and Accounts Office, New Delhi) in the State. Through treasuries effective financial control is exercised over public spending by Government departments in the State. The main function of treasuries is to receive money from the public and make payments of claims against Government on Bills/Cheques. They also maintain initial and subsidiary accounts of receipts and payments and submit it to Accountant General. Along with core treasury functions, this office also deals with the administrative matters relating to Treasuries staff, SAS personnel posted in various departments and the staff posted in the Head Quarter & Internal Audit Organization (Revenue).

To ease the Government business and improve transparency and efficiency in public finances, Department of Finance has integrated I.F.M.S. with e-Kuber system of Reserve Bank of India so that disbursement of Government funds can be credited directly to the payee's Bank Account through Reserve Bank of India and financial position of the State can be known in real time.

For online Receipt Cyber Treasury Portal (CTP) has been rolled out. It has been integrated with S.B.I. Multi Option Payment System (MOPS) and work of integration with PNB PayU is under process. This portal provides facility of online payment to citizens of Punjab.

For better financial monitoring, T&A has been entrusted with the task of implementation of Public Financial Management System (PFMS). PFMS is the Portal developed by Government of India (GOI) to monitor the disposal of funds up to the last beneficiary for Centrally Sponsored Schemes in which the funds are released by Govt. of India(GOI). Treasuries have integrated IFMS with PFMS for seamless transmission of payment data related to Centrally Sponsored Schemes (CSS).

The Directorate has also rolled out I-HRMS, an integrated system for Human Resource Management. This is one point solution for all HRMS activities Pan Punjab.

Internal Audit Organization (Revenue)

Internal Audit Organization (Revenue) was established by State Govt in September 1981 for the internal audit of various revenue generating Governmental departments like Department of Excise and Taxation, Department of Irrigation and Department of Power (Head Electricity Inspector), Department of Transport and Department of Revenue & Rehabilitation.

As described above, initially the Internal Audit Organization (Revenue) was set up primarily to perform the audit of Governmental receipts, however later in the year 1991, it was notified that the purpose of establishing this organization is also to conduct Expenditure Audit. Hence the scope of work of Internal Audit Organization has been changed which is outlined below:

- Audit of Electricity duty, Excise duty, Sales tax, Entertainment tax and Token tax has been performed on routine basis but audit of Passenger and Goods tax continued till 1992-93 as the Department of Legal and Legislature Affairs, Punjab vide its Notification No. 24/Legal/93 dated 1.06.93 repealed the Passenger and Goods Tax Act with lump sum tax.

- Punjab Govt vide Notification No. 4344-47 dated 15.06.2004 and No. 10131-34 dated 22.12.2004 decided to start the Special Audit and Expenditure Audit simultaneously with regular audit of revenue collecting department like Department of Excise and Taxation, Department of Transport and Department of Power, This office vide letter No. II(I)/Restart/Receipt Audit/IAO(R)/06/1388 dated 01.03.2006 started 100% audit from year 2004-05. The audit of stamp duty and registration fees has also been restarted vide letter No. 11-17 dated 01.01.2009.

Principal Accounts Office (New Pension Scheme)

Government of Punjab has operationalised New Pension Scheme (NPS) for its employees who have

entered into Govt. service on or after 01.01.2004 on the pattern of Government of India. New

Pension Scheme has been divided into two parts Tier-I & Tier-II. Tier-I has been made

mandatory to all the employees entering into service on or after 01.01.2004 whereas Tier-II

is optional. A new office which is known as Principal Accounts Office under this scheme

has been set up by the Government of Punjab from March, 2011. This office was established

for

implementation of the New Pension Scheme (NPS) and PRAN generation, depositing contribution,

processing partial withdrawal and final payment cases, correction in PRANs, redressing of

grievances filed by subscribers and correspondence with the related agencies/stakeholders.

The Council of Ministers has declared Principal Secretary Finance as "Authorized Signatory"

and

Director, Treasuries and Accounts as "Designated Authority" under this scheme.

-

Various Activities performed by offices related to NPS.

-

Activities to be done at the level of DDOs :

# Category Sub-Category 1. Registration - On-line initiation of registration of subscribers.

- Editing/updation in the master data of the subscribers.

2. Withdrawal - OnOn-line initiation of final payment cases of subscribers due to exit from the scheme because of superannuation, pre-mature retirement, death etc;

- Initiation of Advances (Partial withdrawal) of the subscribers from the NPS account after completion of prescribed period for various purposes.

3. Grievances - OnResolution of On-line grievances raised by the subscribers at the Central Grievances Management System (CGMS) platform – relation to the DDOs;

4. Miscellaneous - Processing of RTI applications of subscribers;

- Court Cases – High Court and Civil Courts.

- Any other activity as assigned by the Principal Accounts Office, NPS in future.

-

Activities to be done at the level of DTOs

- Authorization of the requests initiated by the DDOs in respect of matters mentioned under DDO.

-

In addition following work is also disposed off by the DTOs :

# Category Sub-Category 1. Transfer of Funds - Drawl and deposit of regular NPS contribution into the subscribers' accounts every month as directed by Government from time to time.

2. Liaisoning with the stakeholders - On-line/Off-line correspondence with the concerned stakeholders.

2. Budget and Reconciliation - Incurring of the budget under Major Head 8342 and 2071

- Reconciliation of figures with AG Office.

-

Role of Principal Accounts Office, New Pension Scheme (NPS), Department of

Finance

- Principal Accounts Office is responsible for the overall implementation of the NPS, supervision in implementation & redressal of grievances, liaisoning with various stakeholders (including carrying out of necessary communication with the CRA, PFRDA, NPS Trust or any other Entity, for the purpose of the scheme) and to monitor timely payment of contribution;

- Monitor performance of DTOs/DDOs with respect to the discharge of their respective duties and compliance of the operation procedures;

- Completion with the Legacy Data (up to 31.03.2011), payment of interest on it as per policy, adjustment of missing credits;

- Preparation of budget for matching share, CRA charges under respective heads of account and its allotment to the concerned;

- Processing of required changes in the IFMS, CRA architecture due to various requirements/new initiatives;

- Issuance of policy/operational guidelines, directions and periodic audit of the payments made;

- To work as bridge between the DTOs and other Entities;

- Any other present of future activity, which has not been allotted down the line.

-

Activities to be done at the level of DDOs :

-

Key Performance Indicators.

- PRAN generation from CRA Mumbai:- Whether registration of all the subscribers is being done under NPS who have joined the Punjab Govt. service on or after 01.01.2004?

- Uploading of contribution:- To ensure monthly deducted contribution alongwith matching share to be deposited in the accounts of subscribers.

- Correction in record:- Whether necessary correction is being made in the cases of correction in PRAN?

- Disposal of online grievance:- Resolving the grievances of subscribers in prescribed time(30 days).

- Disposal of Partial Withdrawal cases:- Disposal of partial withdrawal cases in time bound manner.

- Final Payment cases:- Disposal of Final payment cases to be processed in time bound manner.

- RTI/Court Cases:- Disposal of RTI/Court cases.

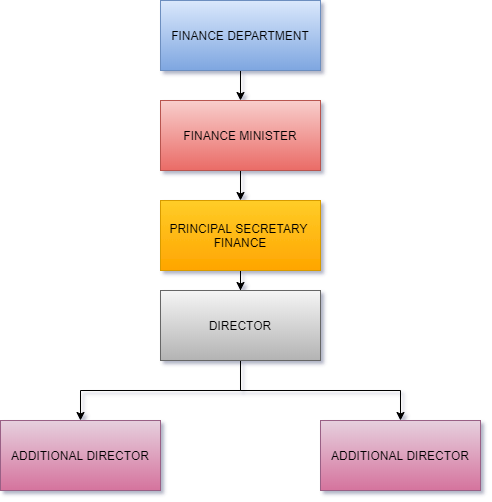

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Branch | Phone No. | Email ID |

|---|---|---|---|---|---|

| TREASURY & ACCOUNTS | |||||

| 1. | Sh. Mohammad Tayyab, IAS | Director | Treasury & Accounts | 0172-2742554 | splsecyexp@gmail.com |

| 2. | Mrs. Simarjeet Kaur | Additional Director | Treasury & Accounts | 0172-2663556 | adtapb17@punjab.gov.in, adtapb17@gmail.com |

| 3. | Sh. Satinder Singh Chauhan | Deputy Director | Treasury Inspection | 0172-2662496 | ddins17@punjab.gov.in, ddins17@gmail.com |

| INTERNAL AUDIT ORGANIZATION (REVENUE) | |||||

| 1. | Sh. Vinod Kumar Mengi | Deputy Director | Audit-2 | 0172-2660235 | vk.mengi@punjab.gov.in |

| 2. | Sh. Bahadur Singh | Deputy Director | Audit-1 | 0172-2660235 | bsingh6364@gmail.com |

| 3. | ShSmt. Surinder Kaur | Deputy Director | Admin | 0172-2660235 | surinder.kaur2@punjab.gov.in |

| NEW PENSION SCHEME (NPS) | |||||

| 1. | Sh. Gurpreet Singh Sudan | Deputy Director | NPS | 0172-2920933 | ddnps@punjabmail.gov.in |

Directorate of Pensions and Welfare of Pensioners

Directorate of Pensions and Welfare of Pensioners, Punjab, had been established in the year 1986 with the sole purpose of serving the retirees. The Directorate acts as a facilitator for redressal of the complaints and getting the pensionary benefits released to the pensioners from their Administrative Departments, A.G. Punjab, Treasuries and from Banks. The Directorate has been effectively executing its policies since inception. The quarterly returns are being obtained from all departments about retiring Government officials to ensure that the retiral benefits are given to the retirees immediately on their retirement. Quarterly meetings with Nodal Pension Officers of all the departments are held to review the progress of pending pension cases of employees of their department. The Directorate makes efforts to get the pension cases finalized along with other retiral benefits in such a way that all the dues of retiring employees are settled in the first instance on or before the date of retirement.

In the event of a retiring employee, who has not been sanctioned these benefits timely, he/she is authorized to make a representation to this office and the Directorate takes up the matter with the concerned Administrative Department for the finalization of their retiral benefits. Directorate also holds Pension Adalats for State Govt. pensioners at district level as well as Headquarter.

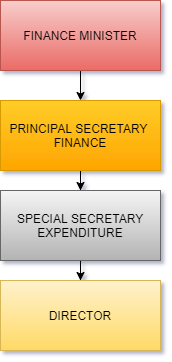

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Sh. Gurpreet Singh Sudan | Deputy Director | 0172-2920933 | ddnps@punjabmail.gov.in |

| 2. | Smt. Nimrat Kaur | Superintendent | 0172-2660180 | dir.ppw@punjab.gov.in |

| 3. | Smt. Manjit Kaur | Superintendent | 0172-2660180 | dir.ppw@punjab.gov.in |

Directorate of Small Savings websiteURL

Directorate of Small Savings, Punjab works under the Department of Finance, Government of Punjab. This Directorate is entrusted with the task of mobilization of savings in National Savings Schemes of Ministry of Finance, Government of India operated through the Post offices and designated Banks in the State. For the promotion and mobilization of savings, this Directorate through its field offices, undertakes various activities like inculcating the habits of thrift amongst the public, both in urban and rural areas, appointment and renewal of small savings agencies under SAS and MPKBY agency system, impartment of training to small savings agents, apprise the general public about the benefit of Government of India's Small Savings Schemes like Kisan Vikas Patras (KVPs), National Savings Certificates (NSCs), Time Deposit 1 years, 2 years, 3 years, 5 years (TDs), Senior Citizen Savings Schemes (SCSS), Monthly Income Scheme (MIS), Sukanya Samridhi Account (SSA), Public Provident Fund (PPF), Recurring Deposit (RD), redressal of investors / agents grievances with cooperation of Posts Offices, authorized Banks and National Savings Institute (GOI).

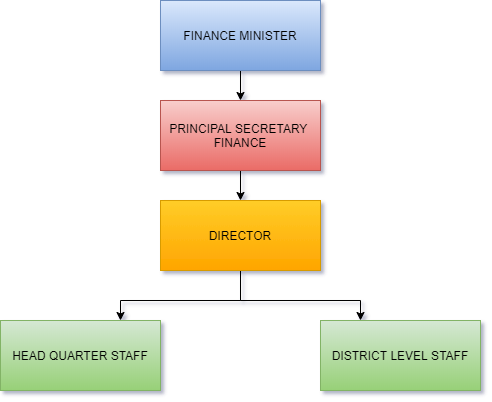

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Smt. Surinder Kaur Warraich, IRS | Director | 0172-2748521 | dir.ss@punjab.gov.in |

| 2. | Sh. Shamsher Singh | Deputy Director | 01874-221069 | dydssgsp@yahoo.com |

| 3. | Sh. Gulshan Kumar | Deputy Director | 0183-2566284 | smallsavingsasr@gmail.com |

| 4. | Smt. Sukhbir Kaur | Superintendent | 0172-2660115 | dir.ss@punjab.gov.in |

Directorate of Public Enterprises and Disinvestment http://www.pbdisinvest.nic.in

- It serves as secretariat for the Core Group of Officers on disinvestment. All proposals of disinvestment are examined by the Core Group of Officers chaired by Chief Secretary and its recommendations are placed before the CMM for consideration and taking final decision.

- It renders advice to the Department of Finance on all policy matters related to Public Enterprises like formulation of broad policy guidelines relating to personnel policies including pay scales, grant of bonus and ex-gratia, creation of posts, economy in expenditure, matters relating to government guarantee, payment of guarantee fee, etc.

- It is the nodal office for implementation of NPS in State Government Public Sector Undertakings and State Autonomous bodies.

- It assists the Committee on Public Undertaking (COPU) of Punjab Vidhan Sabha in examining the Audit Reports (Commercial) of Comptroller and Auditor General of India.

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Sh. Vijay Namdeorao Zade, IAS | Director | 0172-2660063 | secretaryexpenditure2019@gmail.com |

| 2. | Sh. Sandeep Singh | Joint Director (F&A) | 0172-2660074 | pbdisinvest17@gmail.com |

Directorate of Financial Resources and Economic Intelligence (DFREI)

The Directorate of Financial Resources and Economic Intelligence was set up on 1-7-1986. The office of the Directorate is situated at Room No. 15, 7th Floor, Punjab Civil Secretariat-1, Chandigarh.

- Preparation of State Budget Speech and Union Pre-Budget Speech for Hon’ble Finance Minister, Punjab.

- Action and Follow-up of Budget Assurances.

- Preparation of Budget at a Glance & key Statements of Annual Financial Statement (AFS).

- Monthly Note on various Fiscal Parameters presented to Chief Minister, Punjab.

- Monitoring of Cash Flows and Management of Fiscal Position.

- Active Cash Management & Preparation of “Market Borrowing Schedule” of the State.

- Quarterly Review of Trends in Receipts and Expenditure in relation to Budget at the level of Hon’ble Finance Minister, Punjab.

- Convening Periodic Revenue Monitoring meetings with ADs.

- Additional Resource Mobilization & Expenditure Control Measures.

- Action and Follow-up with regard to recommendations of Cabinet Sub-Committee on Fiscal Management, and Punjab Governance Reforms and Ethics Commission (PGREC).

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Sh. Mohammad Tayyab, IAS | Director | 0172-2742554 | splsecyexp@gmail.com |

| 2. | Sh. Gurpreet Singh | Research Officer | 0172-2740434 | dfreifd@gmail.com |

Public Infrastructure Development Board (PIDB)

Punjab has envisioned overall industrial and economic growth through development of world-class infrastructure in the State. To achieve this objective a strong legal and institutional framework has been put in place through creation of Punjab Infrastructure Development Board (PIDB).

The Chief Minister, Punjab is the Chairman of the Board and the Deputy Chief Minister is the Co-Chairman, besides other senior Ministers and Secretaries as members of the Board. The statutory status of the PIDB amplifies the significance provided to the development of infrastructure and private sector participation therein. PIDB has been created under the Punjab Infrastructure (Development & Regulation) Act, 2002 (PIDRA). The PIDRA not only provides broad based overarching regulatory frame work but also consolidates the best practices in infrastructure development. PIDB is a nodal agency for implementation of Public Private Partnership (PPP) Projects in the State and acts as an enabler and a facilitator for providing level playing field for participation of National and International investors in creation of infrastructure in the State.

The State Government places high priority on infrastructure development in and for the State. In view of the vast funds required for infrastructure development, the State Government wishes to encourage the private sector to supplement its efforts in developing the infrastructure facilities by participating in the financing and/or development, operation and management thereof. The private sector, both domestic and foreign, has shown considerable keenness to participate in infrastructure development. To attract private participation in infrastructure development, the State Government recognises the need to :

- Have an overarching legislation to secure a level playing field for private participants,

- Establish a transparent regulatory framework governed by an autonomous regulator, and

- Grant various concessions and incentives to make the infrastructure projects and the investment opportunities viable and attractive.

With this in mind a regulatory framework has been formulated which will provide clear guidelines for all aspects for infrastructure development - from the conception to the implementation, and inter - alia provide for the following:

- The decision making powers and processes, including with respect to selection of projects and of concessionaires;

- The legal basis for grant of concessions to private parties;

- The parameters and structures of Private Participation based on commercially accepted principles such as Build-Operate-and Transfer (BOT), Build-Operate-Own (BOO), Build Own Operate Transfer (BOOT);

- The constitution and functioning of a functionally and financially autonomous regulator who will ensure that the development activities are conducted in a fair and just manner while striking a balance between the inherently conflicting interests of the State, the concessionaire, and the public;

- Promotion and regulation of competition;

-

Safeguarding the rights and interests of the consuming public such that :

- The concessionaire provides adequate service throughout the term of the concession,

- The concessionaire observes relevant safety and environmental protection standards,

- The charges levied upon consumers are reasonable,

- The infrastructure facility is properly maintained throughout the concession, and

- If the infrastructure facility is to be transferred at the end of the term to the Government, it inherits an operational project and not simply a liability; and

- Quality assurance mechanism.

- Dispute resolution mechanism.

In 1998, The Government of Punjab created Punjab Infrastructure Development Board by

enacting "The Punjab Infrastructure Development Bill, 1998".

To overcome the shortcomings of this Act and bring in broad based overarching regulatory

frame work, the Government of Punjab enacted a new Act known as Punjab Infrastructure

(Development

& Regulation) Act, 2002.

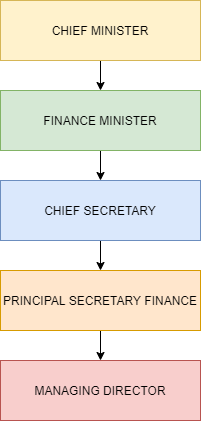

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Sh. Mohammad Tayyab, IAS | Managing Director | 0172-2665410 | mdpidb@gmail.com |

| 2. | Sh. Yashanjit Singh, IRTS | Additional Managing Director | 0172-2600489 | amdpidb34@gmail.com |

| 3. | Sh. Rajdial Singh Bal | General Manager (Project and Finance) | 0172-2665640 | pidbprojects@gmail.com |

| 4. | Sh. Raj Kumar | Technical Advisor-cum-Chief Engineer | 0172-2665565 | advisortechnicalpidb@gmail.com |

Punjab State Lotteries

Directorate of Punjab State Lotteries was established in the year 1968 as a wing of the Department of Finance of the Government of Punjab. The Directorate is located at VIT-TE-YOJNA BHAWAN, Plot No 2, Sector 33-A, Chandigarh, 160020.

The aim of the Directorate of Lotteries, Government of Punjab is to conduct and promote genuine lottery schemes in a transparent manner and in compliance with the rules & regulations.

The objectives of the Punjab State Lotteries are ─

1 To discourage citizens from getting swayed by illegal activities like satta &

matka, by

providing clean & genuine lottery schemes.

2.To mobilize non-tax revenue for the State Government, to be further used for

various Welfare

Schemes.

3.To take advantage of the technological advancements and create an efficient,

effective and

people friendly environment to conduct & promote Punjab State Lotteries.

4.To generate direct/indirect employement opportunities in the state of Punjab.

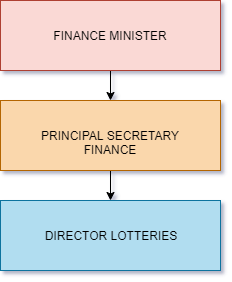

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Dr. Vijay Namdeorao Zade, IAS | Secretary Expenditure | 0172-2741145 | - |

| 2. | Sh. Yashanjit Singh, IRTS | Director Lotteries | 0172-2740813 | director.lottery@punjab.gov.in |

Punjab Infrastructure Regulatory Authority http://www.pira.punjab.gov.in

PIRA intends to create an ecosystem, which would facilitate the infrastructure development

in the

State of Punjab, therefore creating a win-win situation for all stakeholders.

The mission at Punjab Infrastructure Regulatory Authority (PIRA) is to provide a regulatory framework to ensure the success of Infrastructure projects in Punjab, especially dealing with new issues that arise from raised commercialization, competitions and private sector participation.

PIRA has been established in accordance to the Punjab Infrastructure ( Development & Regulation) Act 2002, with the following functions:-

- to aid and advise the State Government in the formulation of appropriate policy or guidelines relating to tariff.

- to conduct the public hearing regarding the approval of proposed infrastructure projects in terms Of section 30.

- to determine, modify or vary the tariff on the basis of the concessions granted to the concessionaires and the interest of the consumer.

- to regulate the working of the concessionaire and promote efficient, economical and equitable performance, including laying down standards of performance of the concessionaire in regard to the service to the consumer.

- to adjudicate upon appeal preferred to it against an order passed by the Board or the State Government related to the approval of an infrastructure project or the award of a concession.

- to adjudicate upon disputes inter-se two or more Concessionaires, operators of infrastructure projects, the State Government and the Board.

Initially PIRA's mandate was only for PIDB facilitated projects, but realizing the positive role. PIRA could play in the infrastructure sector, PIRA's mandate was enhanced by an amendment to the PIDRA Act 2002 in 2017, whereby the following function was included in PIRA's scope.

- to adjudicate upon, as an Arbitrator, the disputes inter-se between two or more contractors, or a contractor/contractors, on one side and a Department, Public Sector Undertaking, Board, Corporation, Society or Agency under the control of the State Government on the other side, regarding the creation, development, maintenance and operation of infrastructure related projects and for matters connected therewith or incidental thereto of the State Govt. under the Arbitration and Conciliation Act, 1996 (Act 26 of 1996), where the claimed amount is five crore rupees and above.

Thus PIRA envisages to create a professional environment for developing a functional infrastructure sector in Punjab and ensure user friendly, cost effective and speedy arbitration process.

ORGANIZATIONAL STRUCTURE

| # | Name | Designation | Phone No. | Email ID |

|---|---|---|---|---|

| 1. | Sh. Jatinderbir Singh, IAS (Retd.) | Chairman | 0172-2298051 | - |

| 2. | Sh. Manmohan Singh, Chief Engineer (Retd) | Member | 0172-2298051 | - |

| 3. | Sh. Dalwinderjit Singh, PCS | Secretary | 0172-2748519 | acfapira@gmail.com |